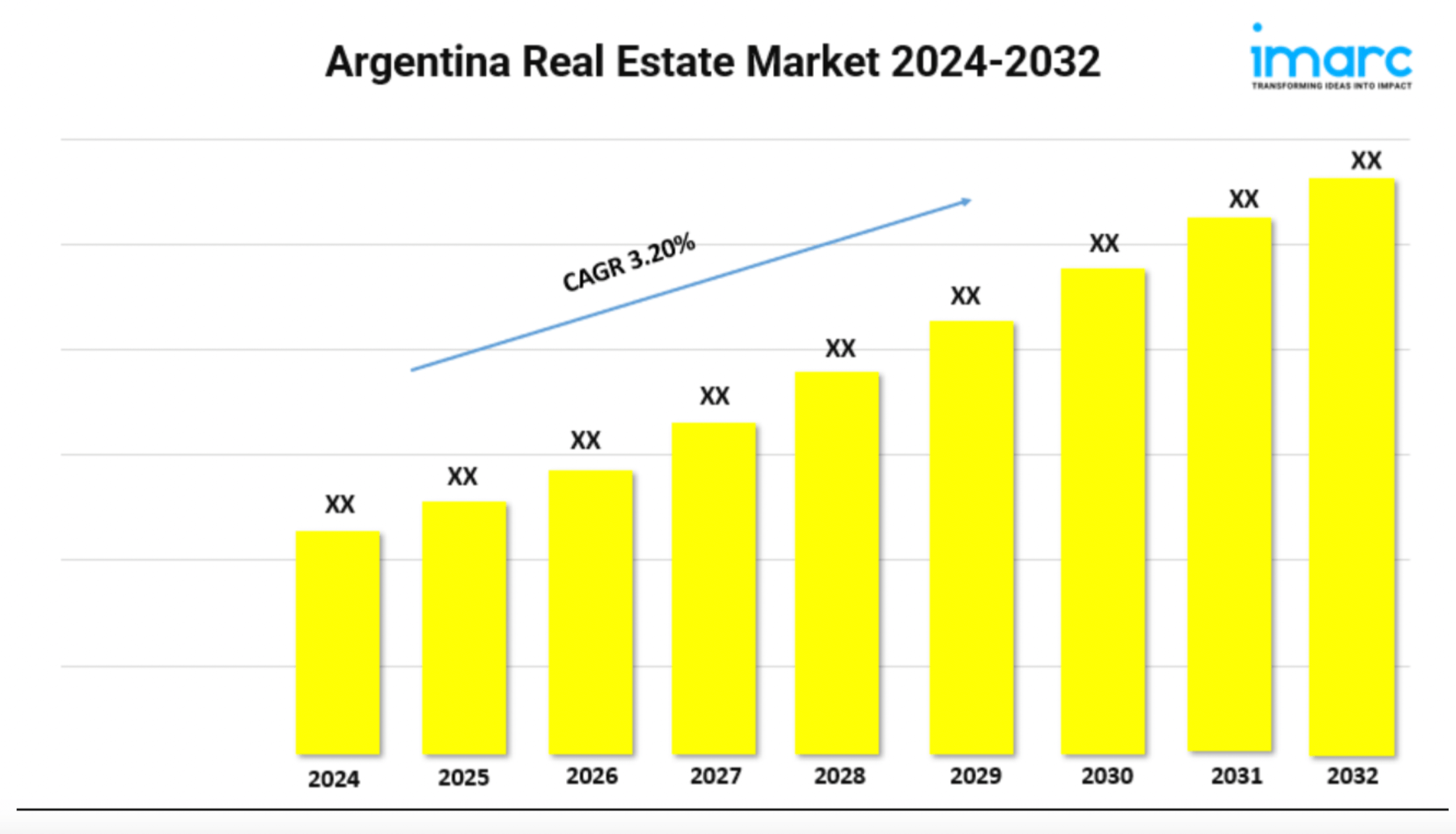

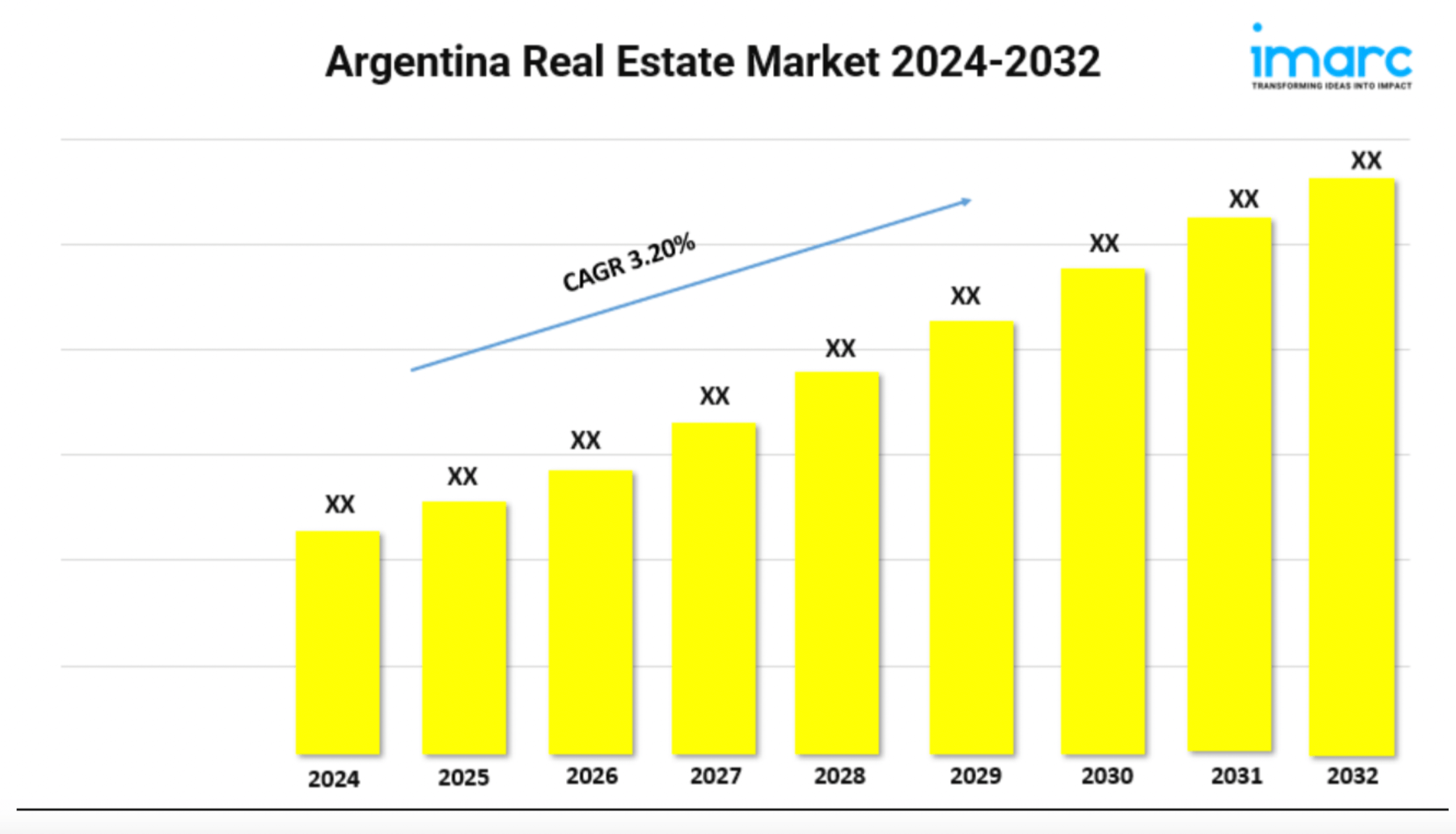

The Argentina real estate market shows promising growth, having reached a size of US$ 42.3 billion in 2023, with projections by IMARC Group to grow to US$ 55.12 billion by 2032 at a CAGR of 3.20%. Several key factors contribute to this expansion:

Key Growth Drivers:

1. Inflation Hedge: Due to Argentina’s persistent inflation and currency volatility, real estate is seen as a stable investment, leading to higher demand, particularly in Buenos Aires. 2. Urbanization: Rapid urban growth in cities like Buenos Aires, Córdoba, and Rosario is creating a need for residential and commercial spaces, fueled by people moving from rural areas for better employment opportunities. 3. Government Initiatives: Reforms, including tax incentives, subsidies, and investments in infrastructure such as transportation and utilities, are making various regions more attractive for real estate investment. 4. Tourism & Short-Term Rentals: Popular tourist destinations like Patagonia and Mendoza are drawing significant investments, particularly in vacation homes and short-term rentals, driven by both domestic and international travelers. 5. Remote Work Trend: The rise of remote work has increased demand for suburban and smaller-town properties, offering better living standards, affordability, and space for home office setups. These trends suggest a diversified market poised for steady growth, with key opportunities in both urban and tourist-heavy areas.